The 3 Factors That Make Your Funding Application Competitive

Accessing government funding for the first time might seem daunting without knowing how the process works. If your business is new to the funding landscape, it’s important to understand the various funding types and how to navigate the funding process.

Once you’ve read up on that, it’s time to select suitable programs. To do that, you need to know if the proposal you’re about to write will be competitive enough to justify funding.

The Anatomy of a Government Funding Program

Each Canadian government funding grant or loan has a unique set of objectives and eligibility criteria that an applicant needs to be aware of before they apply. Most programs have a website and/or guide that dives into the details of the program in more depth. These guides inform potential applicants of:

- Why the program exists;

- What and who it’s looking to fund;

- How applicants will be reimbursed; and

- How to prepare and submit an application.

Before you consider a funding program, it’s important to understand if you’re eligible to apply. This is broken down into (1) eligible applicants, (2) eligible projects, and (3) eligible expenses. If you or your project don’t align with all three of these eligibility criterion, it’s not worth your effort. Contact a Government Funding Planner or check out the list of Canadian business grants and loans to find alternative business funding opportunities.

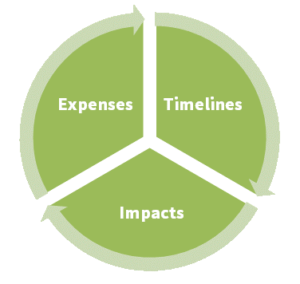

How to Develop a Competitive Government Funding Application

Even if your business does meet all of the baseline eligibility criteria, it doesn’t mean you’ll be awarded funding. It’s important to know the difference between an eligible application and a competitive application. There are three factors you should evaluate to understand how competitive your potential application will be.

Project Timelines

Gather your project team and start to build a roadmap or Gantt chart of the key activities and milestones that occur from project inception to completion. Timelines are pivotal to the success of your application. With the majority of business grants and repayable funding, your project spending cannot commence until you are approved for funding. In some cases, it’s upon the submission of your funding proposal, so check which one it is. This could be the difference between a competitive and disqualified app, so do your background research or talk to a Mentor Works team member to avoid disappointment.

Project length also has a bearing on its fit for several government funding programs. A project that is executed too quickly might not have the scope required to build up an adequate budget or sufficient results. On the other hand, certain funds might restrict the length of projects to fall within a certain spending schedule or the program’s active lifespan. If your project is too long, it’s at risk of being declined. It’s worth noting that programs with intake dates might dictate when you’re applying based on their deadlines and your project’s proposed start date.

Finally, certain programs will require impacts within a specific length of time. Even if project activities are completed within the required timeframe, if the resulting benefits aren’t realized until far later, they could be excluded from the project’s impacts.

Project Expenses

In addition to timelines, your project team should also evaluate your project expenses. You’ve reviewed the government program’s website and application guide, so you’re aware of what’s eligible and ineligible. Now it’s time to focus on exactly what to include in your application. You should focus on building a budget large enough to justify the effort of applying. Unsure? Plug your numbers into the Project Funding Calculator and find out.

Also be conscious of coverage limits to certain categories of expenses. For instance, some business expansion grants limit project management-related expenses to 10-15% of the overall budget. Reliance on certain expense categories can also affect the competitiveness of a program. If a government program is looking to support more of the technical expertise behind a project instead of the capital expenses but 80% of your project costs come from equipment purchases, the government agency might not be interested in funding it.

Business that are financing or leasing capital should investigate the impact on that line item’s eligibility for funding. Be very conscious of how the program will treat these types of capital payment structures. Some might allow it; others forbid it or will only cover a portion of these expenses.

Project Impacts & Results

The government offers these incentive programs to spur specific results that fuel economic development. These programs typically target a specific topic such as innovation, job creation, skills development, or export revenue growth. If your application can’t effectively speak to these objectives, it isn’t going to resonate with the government funding agency’s review board.

Programs vary on the amount of guidance they give to their applicants. While some programs provide a formula to calculate the project’s perceived benefits, others discuss it at a high level with internal metrics that they utilize when reviewing applications. As you’re evaluating your project, be conscious of the business grant’s main objective and make that the theme of your application.

Create a Proactive Funding Plan

Each of these three elements are crucial to the success of your next Canadian business funding application. Ensure that you are partnering with someone who is well-versed in the government program you’re applying to. They can help you optimize your timelines, budget, and impacts to get the most out of the program and ensure a competitive application. They’ll also make sure you’re applying for the most accessible and relevant programs.

Some programs are very popular and competitive, requiring an extremely focused application to be successful. Regardless of the program, the effectiveness of your application relies on a story that optimizes your timeline, budget, and impacts in a realistic and clear manner.

If you’re having a difficult time understanding a program’s theme or how to curate the story, this Business Funding Guide could help. It explores basic eligibility criteria, types of projects well-suited for funding, and insight on developing competitive applications. Use it to form a government funding strategy unique to your business!

Updated: September 10, 2019.

Thank you for information.we are newly here in the field of co_oporatives.we did not know how to apply for funding.May you give us more tips of how to apply for agricultural planting equipment .our co_oporative is Mthobolwazi agricultural primary co operative.We have a piece of land 41,2 hecters,we are situated at kutlwanong Odendaalsrus Free State South Africa.

Hello Themba,

As it turns out Mentor Works is an expert in assisting companies apply for programs in the Canadian government funding space. It is important to note that there are country and regional based nuances when it comes to program landscapes for other countries. If you are applying for Canadian programs for Canadian companies, we can be of assistance and I would strongly advise that you connect with us by filling out one of our contact forms here. If you are looking for assistance for South African programs, you may be best served by exploring more local groups for assistance.