Product Life Cycle Management: Overcome Declining Competitiveness

Businesses rarely remain competitive with the same product offering they’ve always offered. In these rare cases, companies operate in a unique niche that presents high barriers to entry (capital, expertise, IP, etc.), and benefit from a low-to-no competition environment. No considerations need to be provided for the product life cycle since competitive forces are not driving innovation.

More than likely this is not the case for your business, and you need to constantly evolve your offering to stay ahead of competition and meet changing customer preferences.

As a result, your business continuously engages in research and development, testing and trialing, launching, managing the offering, and phasing it out at the end of its useful life. Even if you don’t formally engage in these activities, it’s likely a standard practice your business already does. Therefore, it’s important to look at the ways your business can optimize the process, effectively saving time and money while helping get more products and services to market faster.

Stages in the Product Life Cycle

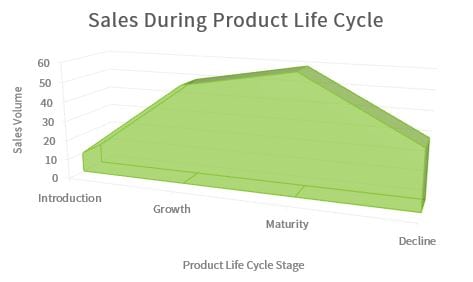

While there are some variations in how each stage is labeled, it’s generally agreed that there are four distinct stages in the Product Life Cycle:

- Introduction: Product is ready for commercialization and is brought to market. Sales volumes in this phase are typically low, especially if it’s first to market in a new space.

- Growth: Marketing kicks in and customers begin purchasing in higher volumes.

- Maturity: Approaching saturation point, customers are aware of the product; this is where you’ll see the widest level of adoption.

- Decline: Competition has caught up, new features or new products are available elsewhere. In cases where you’ve fully saturated your market, there’s no additional room for purchasing and sales decline.

Depending on the complexity of your product/service and the space you operate in, there may be sub-stages or additional phases to consider, but from a high level this model is applicable to most businesses. The length of time between each stage, and from launch to end-of-life (EOL) varies greatly based on the business and industry. Regardless, without product innovation, sales will eventually decline.

End of Product Life Cycle Strategies: Replace or Extend

In the final stage, most companies adopt one of two strategies: product replacement (i.e. new introduction to the market) or product extension.

- Product Replacement: Using the above graphic, think of product replacement strategies as coming into focus in stage two or three (depending on your industry) to ensure you have a new product ready to hit the market and close the sales gap in the decline stage. This presents new sales opportunities but also results in significant costs from new product R&D, labour, and so on.

- Product Extension: If a product is still market viable and you can develop new features or appeal to a new market, this is a great strategy. Product life cycle extension reduces the burden of R&D and product launch and allows you to build on existing market penetration. Apple commonly adopts this with their products by maintaining a flagship product and constantly releasing new versions, hoping consumers will move to the newest device. The downside of this strategy is that unless you can constantly iterate your product, you eventually will have to retire it and introduce something new to the market.

Top Four Most Common Product Life Cycle Gaps

Companies occasionally lose sight of their customers and market. If you’re not closely monitoring customer expectations, or lack insight into product sales trends over a monthly, quarterly, and annual basis, then you’re likely not aware of where your products currently sit in their life cycle.

Mentor Works helps businesses understand where products exist in the market and whether they’re adequately prepared for a maturing or declining product. Not sure if you’re in need of support? Here are some of the most common gaps and issues with life cycle management that we encounter:

- Nobody Monitors Product Life Cycle: This happens more commonly in smaller operations where everyone manages multiple parts of the business. Products are managed, but the team doesn’t focus on long-term trends or where the product is in the life cycle. In cases where this is outright ignored, its hard to tell if declining sales are a result of external market factors or are signaling the end of the product life cycle.

- No Data Analysis: There are lots of tools, both paid and free to use, that companies can use to monitor product life cycle. Without data, it’s hard to pinpoint where a product currently stands and how much time/resources to invest in innovation. In these cases, we recommend establishing a basic worksheet to track sales volume and product-related traffic over relevant periods of time (depending on your industry, that might be weekly, monthly, quarterly, or even annually). From here, you can do some basic analysis to determine where the product is and when you should invest in new product research and development.

- Not Watching Competitors: I hear from many clients that their products/services are the best offering on the market. And while this may be true, it’s still important to watch what the competition is doing. How are they similar? What’s different? What are you hearing from customers? When you win a deal, what feedback are you getting from your customer? What about when you lose? These are all important – and sometimes hard to ask – questions. Maybe net promoter score (NPS) and similar metrics aren’t fully applicable, but you can send out regular surveys and solicit feedback from the market at no cost to help you better understand how your product is received in the market.

- Not Developing, Monitoring, and Improving Management Processes: Most businesses are in a constant cycle of R&D, product launch, product maturity, and product retirement/replacement. This is how businesses grow and thrive in today’s economy. If you aren’t paying attention to the lessons learned, you could be spending a lot of money needlessly. When you iterate or innovate, where can you save money? How can you use existing market penetration to launch new products faster or with less spend on marketing? How can you improve the speed of R&D processes to get new products ready for launch faster? How can you extend your product’s life cycle?

Identify Gaps in Your Product Life Cycle

As management consultants, the Mentor Works team engages our clients to help them understand their unique product life cycle management needs and gaps. This leads to better management of R&D costs, launching more products faster, and better management of products in general. Here’s some common tips we provide to help our clients improve the way they manage products today:

Invest in Data Management

If you don’t have a customer relationship management (CRM) or enterprise resource management (ERP) system, start looking now. I’m a firm believer that every business should use a CRM at the very least, and if warranted, an ERP system too. If you’re just starting out or have a very small client network, look at easier-to-implement solutions such as a customized Excel workbook. If you’re starting to grow and want to better understand your sales, then look at solutions that are more robust but still easier to deploy such as Zoho. As you grow, you’ll likely need to customize your CRM heavily, but starting out you should track key metrics to get an idea of how your customers and your products operate in the market. Key metrics to consider include:

- Sales Cycle: Time from initial contact to purchase.

- Conversion Statistics: Lead generation, lead to opportunity, and opportunity to closed sale.

- Average Sales Size: Segment by customer type, industry, geography, etc.

From here, you can begin to get an idea of how your product is working in the market. With time, you’ll also be able to conduct longitudinal analyses looking at how the product operates over time.

Get External Feedback

Develop and send customer feedback surveys, interview your customers, interview people who ultimately purchased your competitor’s products, etc. It’s critical to seek responses from objective third parties who can give you clear feedback on the product. This can be used to validate your product and position, but it can also help illuminate critical issues.

Keep Innovating and Iterating

Often we see companies, particularly smaller firms, launch a product and make that the core focus of the business, when in reality they should be looking at the next product opportunity. Will your product be relevant in three years? What about five? How will you continue running the business in that time frame? What will you bring to market to help the company grow? While there’s no set timeline of when you should be investing in a new product, and in many cases you should always be developing new products, have a new product ready for launch before your current product enters the maturity stage. This allows you to proactively schedule a launch and prevent sales lapses during the declining and End of Life phases.