Connected and Autonomous Vehicle Technology Development Timelines

Few automotive trends require foresight into technology development, consumer preferences, and regulatory requirements like connected and autonomous vehicles. For C/AV technologies to reach mass market adoption, all three of these elements must align, with consumers and government regulators being confident in the technologies used. Without tested and proven high-quality systems, governments won’t let C/AVs on the road and consumers will be unable or unwilling to purchase them.

Testing and limited use of C/AVs has begun; it’s expected that vehicles will reach full autonomy by 2030 and mass market acceptance by 2040.

There are many steps required to validate connected and autonomous vehicle technologies; manufacturers and government regulators must keep in mind that the shift is gradual and there will be a mix of autonomous and non-autonomous vehicles on the road. This mix is essential to establishing an autonomous future but will create issues along the way. Will autonomous systems be able to identify human-controlled vehicles and avoid collisions, or will human driving variability lead to escalated numbers of accidents? This is one of many questions that need to be answered prior to mass market adoption.

Connected and Autonomous Vehicle Technology Readiness

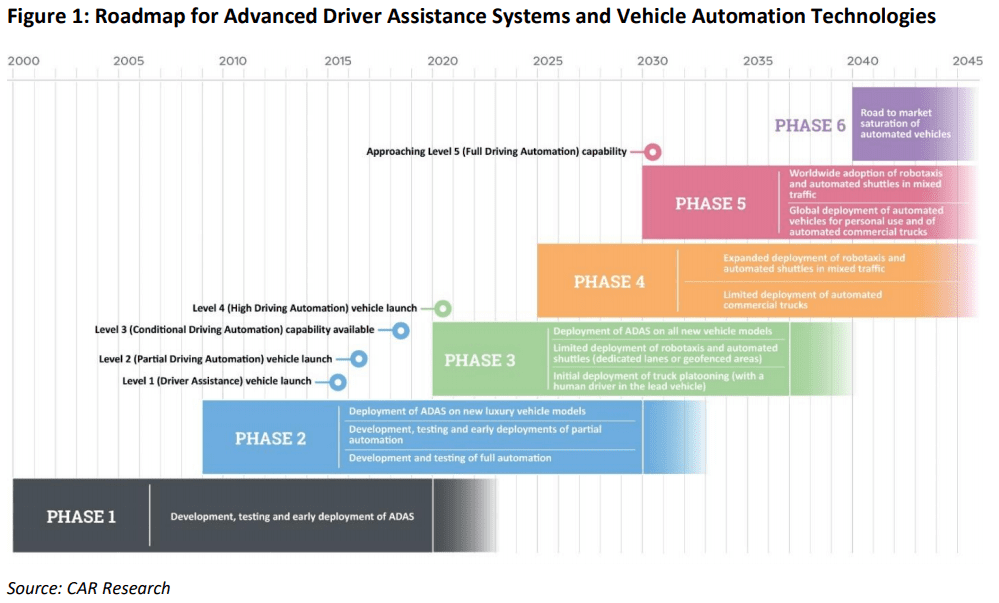

The Center for Automotive Research (CAR) took a technology-focused approach to forecasting C/AV adoption timelines, with the main findings being that full automation of driving will be possible by 2030. Automotive technologies will rapidly improve and lead to autonomy over the coming decade, with a couple key steps in technology readiness along the way.

In a five-phase development model (Phase 6 to signify market saturation, not technology readiness), most automotive manufacturers are currently shifting from Phase 2 to Phase 3 where advanced driver awareness systems are incorporated into all models (luxury and economy) and initial/limited deployment of autonomous vehicles is integrated into a wider range of vehicles such as robotaxis, shuttles, and commercial trucks.

Phase 4 autonomous vehicle technologies (expected around 2025) will bring many C/AVs out of piloting or test scenarios and into actual applications on real roads. Traffic may be mixed or restricted (requiring C/AVs to use specific lanes) depending on the vehicle and geographic region until most traffic is autonomous.

Phase 5 technology readiness (expected around 2030) will lessen the restriction of C/AVs to certain lanes or other measures to avoid mixed traffic. At this stage, almost all new vehicles will be autonomous by default or be well-equipped to switch between human driving and autonomous driving capabilities. Passenger vehicles, utility vehicles such as shuttles, and commercial trucks should all be capable of autonomous driving and have the confidence of consumers and regulators to purchase without hesitation.

Consumer Adoption Timelines of C/AVs

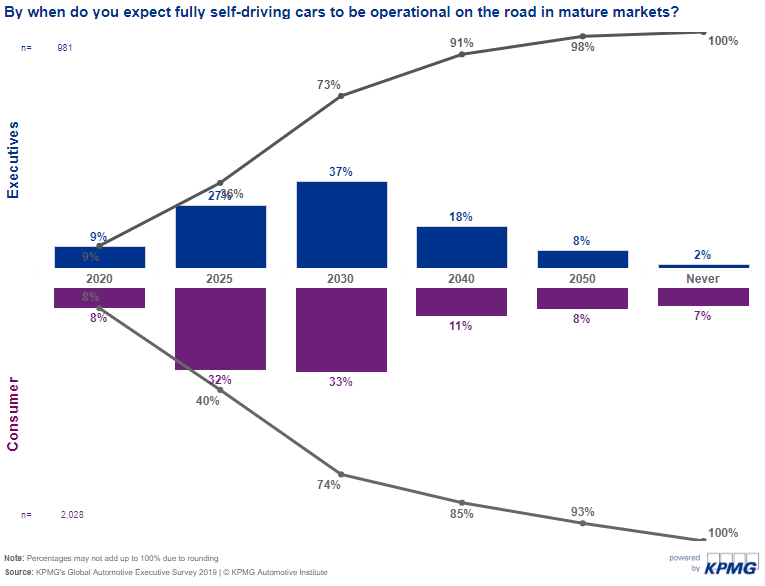

Forecasting connected and autonomous vehicle technology readiness is one way to view adoption, but another important one is identifying when consumers and automotive executives believe they’ll be on the road. KPMG’s Global Automotive Executive Survey asked exactly this; the results indicate that the majority (73-74%) of people believe autonomous vehicles will be operational on roads by 2030. By 2040, almost everyone (85-91%) believes autonomous vehicles will be operating on public roads. Those pushing for early adoption by 2025 are fewer, but still represent a large portion of those surveyed (36-40%).

This measure shows that consumer and automotive executive expectations are well aligned to the state of current technological readiness. Automotive companies and governments have done a good job at taming optimism and speculation about autonomous vehicles; they’ve also communicated that there are many steps needed before autonomous vehicles can be on public roads.

Some surveyed consumers and automotive executives take a pessimistic approach to autonomous vehicles, however, stating that they may not reach public roads until 2050 or may never be possible. This is the stance of many people surveyed, with 10% of automotive executives and 15% of consumers expecting a 2050 or longer timeline before autonomous vehicles become road-ready in mature markets.

Regulatory Islands of Connected and Autonomous Vehicles

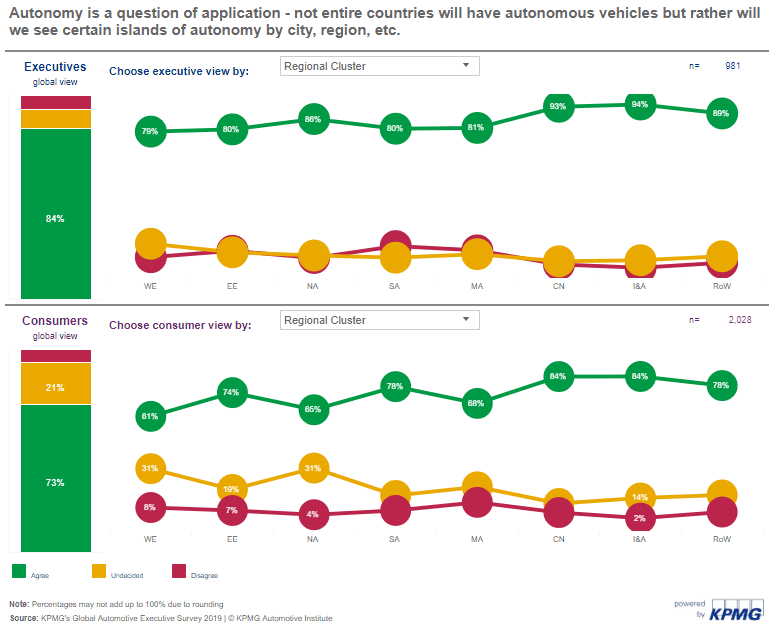

Regulating autonomous vehicles will be a difficult process for global governments as there’s no clear consensus about when or how to support the transition. KPMG’s Global Automotive Executive Survey provides excellent data to visualize that instead of entire countries becoming open to autonomous vehicle use, sub-national jurisdictions such as cities or regions will make the decision. As a result, autonomy will be mostly sporadic and available to those who live in areas where autonomous vehicles can be driven – either in restricted or mixed traffic.

There are some regional differences to this way of thinking, with consumers in a few regions (including North America) not agreeing to the same degree as they do in other markets. Even with these outliers, most automotive executives and consumers heavily favour the idea that autonomous vehicles will be rolled-out on a market-by-market basis.

Regarding adoption timelines, this “islands of autonomy” concept does not shift mass market adoption projections much. This concept simply expresses that the transition to connected and autonomous vehicles will not be instantaneous over a few model years. It will take government regulators years to implement C/AVs, with test data and connected vehicle infrastructure necessary along the way.

Learn More: Connected and Autonomous Vehicle Technology Development

With the mass market acceptance of connected and autonomous vehicles still 10-20 years away, manufacturers and technology developers still have an opportunity to establish themselves as C/AV leaders. To do so, company executives need to establish a growth and investment plan that emphasizes innovative R&D.

To learn more about how to build a strategy for growth in the connected and autonomous vehicle sector, please download our Electric and Autonomous Vehicle Trends white paper.