Electric Vehicle Technology Development and Adoption Timelines

Electric vehicle technology adoption must marry the readiness of manufacturers, consumers, and government regulators, all of whom have expressed varying levels of caution and optimism about the widescale adoption of EVs. There’s no one group that can independently bring electric vehicle technologies to the forefront; rather, it takes the collective and coordinated interest of all stakeholders to make development and integration feasible.

Early adopters, both manufacturers and consumers, have already started the shift to hybrid and electric vehicles, but when will they reach mass adoption?

While pure battery electric vehicles may be the goal in terms of environmental sustainability, most automotive manufacturers are investing heavily in hybrid electric vehicles that simultaneously enable the advancement of battery technology while providing the flexibility and convenience of internal combustion engines. This reality of the automotive landscape suggests there will be a mixture of powertrain technologies available to consumers well into the future.

Manufacturer Investment in Electric Vehicle Technologies

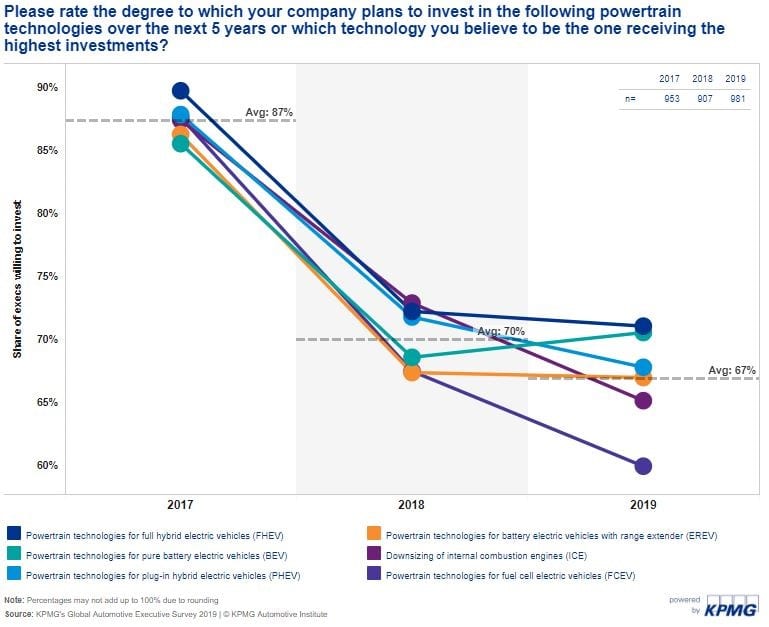

KPMG’s Global Automotive Executive Survey offers an insightful look into how manufacturers are investing in powertrain technologies. While fewer companies are committed to investing research and development funds into these types of technologies than they were in years past, it seems that there is now a more focused investment strategy, suggesting that there is less of a widescale “invest in everything” approach. Instead, automotive manufacturers have chosen their preferred technology type and will invest in it most heavily, while other powertrains considered less important will not receive much or any investment.

In 2019, there is a wider gap between the top powertrain technology (full hybrid, 71% of manufacturers) and the least popular type (fuel cell electric vehicles, 60%) than in previous years where essentially every manufacturer planned to invest in all technologies evenly (4%-6% gap between most and least popular investment focus). This clarity in vision supports the idea that full hybrid electric vehicles and pure electric vehicles will be a main investment area moving forward, with other powertrain technologies still being important, but less so than previously believed.

Forecasting Hybrid and Electric Vehicle Adoption Timelines

Another way of anticipating the integration of electric vehicles is to look at forecasts of market share over the next couple of decades. How will new vehicle sales respond to the electrification trend, and what types of electric vehicles – either pure electric or hybrid options – are likely to receive the most support from consumers?

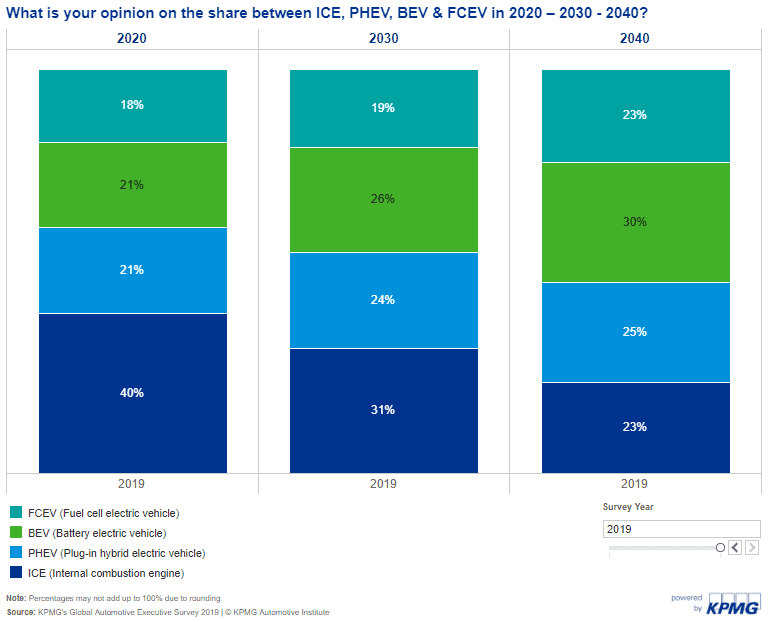

Looking ahead in the short-term market mix for new vehicles, ICEs still have a dominant hold and should account for 40% or more of the global automotive market. Behind the leader, there is a very even mix of powertrains, including an even split between plug-in hybrids and battery electric vehicles (21% each), and fuel cell electric vehicles not far behind (18%).

By 2030 there’s a significant drop-off expected, with internal combustion engines accounting for 31% of new vehicle sales – 9% less than it received a decade prior.

Every category of electric/hybrid vehicle is expected to pick up this slack, although not evenly. Battery electric vehicles could account for 26% of the 2030 new vehicle market, with plug-in hybrids slightly behind at 24% and fuel cell electric vehicles remaining fairly stagnant at 19%. Then by 2040, the market changes even further and could have most types of electric and hybrid vehicles outperforming sales of combustion engines.

ICEs could drop to approximately 23% of global market share, while BEVs (30%), PHEVs (25%), and FCEVs (23%) surge to become more competitive options.

Of course, these forecasts rely on many variables like technological and infrastructure readiness, but they are more than possible given current electrification trends. A mix of drivetrain technologies is a factor that technology developers, suppliers, and OEMs need to consider as it’s likely that there will never be one definitive solution in the market. Factors such as vehicle application and size, industrial policies, and dependency on raw materials will require a mix of technologies and automotive companies need to deliver on customer expectations.

Develop a Strategy for Electric Vehicle Technology Innovation

Manufacturers, technology developers, and other Canadian businesses have a significant opportunity to progress automotive innovations. As the ever-growing market for electric and hybrid vehicles surges, more innovators need to commit to progressing systems and components that will be used in next-generation designs. Fortunately, Canadian businesses can access government grants and loans to offset research and development costs; this can help address R&D opportunities more quickly.

To learn more about the progression of electric vehicle technologies, please download Mentor Works’ Electric and Autonomous Vehicle Trends white paper.

Hi Jeff, wondering where I can get more information about bringing some EVSE manufacturing to Canada. Something to help convince us to keep manufacturing here vs going somewhere overseas.

Hello Matthew,

Thank you for reaching out to us on this. There are a few current and upcoming government funding programs aimed at supporting the Canadian manufacturing sector. These grants can really make the difference if you are in the decision process for where to grow. Please reach out to us by filling out a contact form on our website here, and we can have a team member reach out to you with more details.