Canada’s #1 Government Grant Writers

Dedicated to Streamlining the Funding and Grant Application Process For Your Business

Let’s Find You Funding

You can utilize our grant writing services if your Canadian business is:

Partnered With

How We Connect Businesses with Funding

Funding Discovery Call

During a half hour call, we’ll get to know your business and what upcoming projects you have over the next one to five years so we can create a list of government grant and loan programs that your business may be eligible for.

Application Writing

Once we have a grant or loan program in mind, our application writing team will ask you a few questions about your business then take care of writing/submitting your application.

Be the First To Know About New Programs

New government funding programs open every week, and ongoing programs accept applications with a short intake window. Our Business Development team lets our clients know about new programs and intake periods before they’re announced on our site.

Why We’re Passionate About Government Funding

A Simplified Approach to Funding

To stimulate innovation, economic development, and competitiveness, Mentor Works provides Canadian businesses with tailored, dynamic expertise to access government funding solutions. Our simplified approach allows businesses to accelerate their top strategic priorities and focus on what they do best.

Our Experienced & Hardworking Team

Mentor Works’ team of government funding specialists work directly with clients to design and implement tailored solutions to support business growth. Our team has expertise in a diverse range of industries including manufacturing, healthcare, finance, and advanced software and hardware technologies.

Helping Businesses Access Grants and Loans

For over a decade, Mentor Works has been a critical factor in helping businesses identify and leverage growth opportunities. We work with hundreds of growth-oriented companies each year to enable their strategic plans and drive greater productivity, innovation, and exports.

Why Apply With Mentor Works?

Purpose Statement: To stimulate innovation, economic development, and competitiveness, Mentor Works provides Canadian businesses with tailored, dynamic expertise to access government funding solutions.

Honesty

If we don’t believe your business will be approved for a program, we won’t write it.

Simple as that.

Success Rate

We live and breathe government funding. With over a decade of experience, we’ve become Canada’s #1 application writers.

Time Savings

Applications can be upwards of 80+ pages! We provide our clients an average of 95% time savings, freeing up your internal resources.

Outside Perspective

You know your business, we know funding.

Our application writers are masters

at turning your innovative projects into

applications that impress the government.

Insider Knowledge

We’re in contact with the federal and provincial governments every day to know when new programs are releasing and

what businesses should be applying.

Apply Early

New programs open weekly, and ongoing programs have short application deadlines.

We keep track of these timelines and reach out to you when a relevant program opens.

Funding FAQs

Client Testimonials

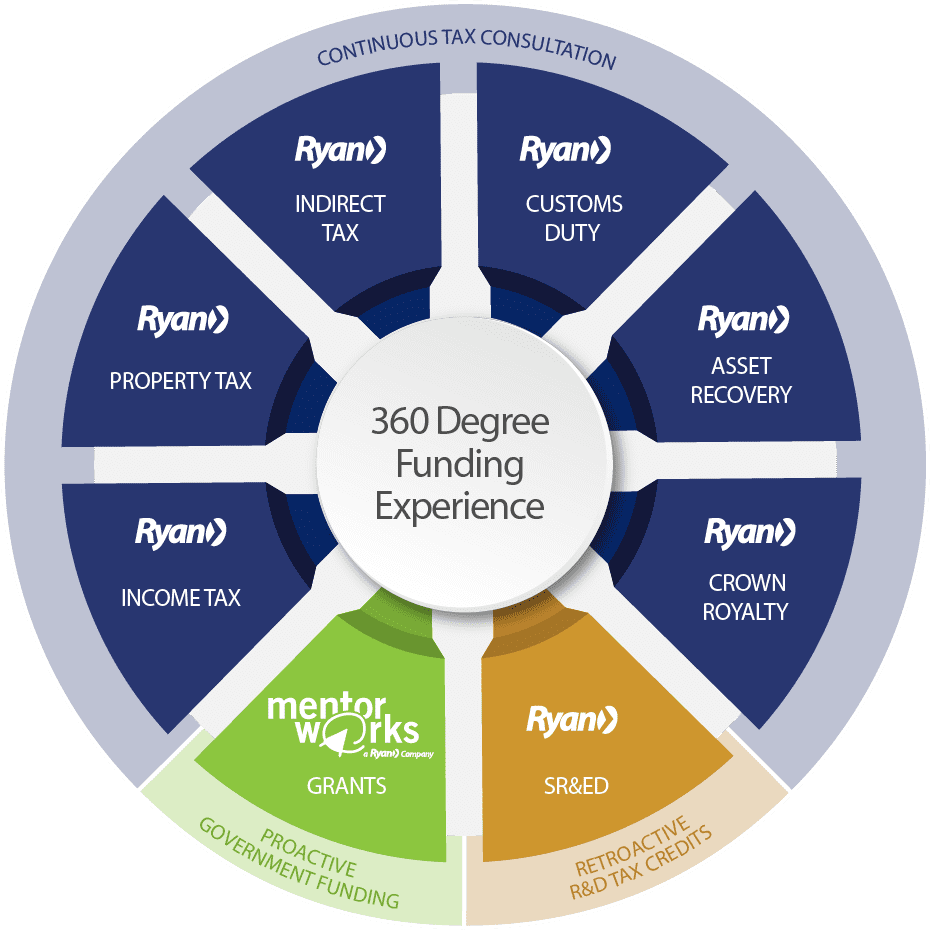

Get a 360 Funding Experience with Ryan

What Services Can Ryan Offer Your Business?

Mentor Works is only a portion of the funding services we offer our clients. We’re part of Ryan, the largest firm in the world dedicated exclusively to business taxes. Operating in over 60 countries with more than 20,000 clients globally.

Depending on the progress of your strategic growth projects, you may be eligible to receive:

- Proactive government funding through grant, loan, or wage subsidies for eligible projects that haven’t started yet;

- Continuous tax consultation through various tax services for eligible projects that are actively being worked on; and

- Retroactive R&D tax credits for R&D projects that have already completed are currently active through the SR&ED program.