Shifting Automotive Technology Preferences Provide Global Opportunity

Automotive technologies are constantly improving to meet customer demand. The popularity of cutting-edge, technology-filled vehicles continues to increase across the world; therefore, automotive suppliers and technology developers must be willing to develop these systems. There are incredible opportunities for businesses who respond to growing interest for electric, autonomous, and connected vehicles. Canadian automotive companies should use these trends to their advantage.

Deloitte’s Global Automotive Consumer Study is an annual survey of vehicle customers across the world. Since 2009, Deloitte has used this report to help the automotive industry respond to new growth opportunities. Their 2017 report used responses from consumers in the world’s largest automotive markets, including the U.S., German, Japanese, South Korean, Chinese, and Indian markets. Findings are based on surveys distributed to over 22,000 consumers across 17 countries worldwide.

Through the report, Deloitte identifies how advanced vehicle technologies are being adopted and what consumers’ perceptions of those technologies are. Some of the most interesting points from Deloitte’s report have been summarized through this article.

How Autonomous Should Vehicles Be?

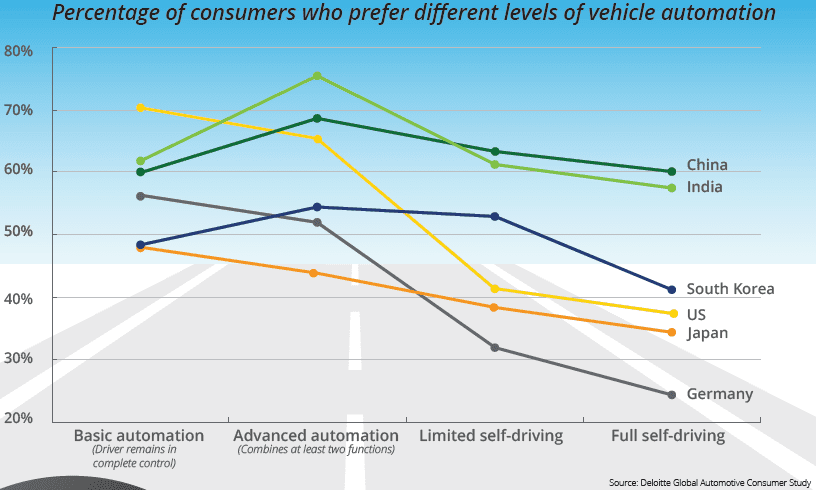

Consumer demand and opinions vary greatly by market; some are wary of major technological changes while others embracing them wholeheartedly. As autonomous vehicle technologies require consumers to trust their safety to computerized systems, there is a certain level of consumer trust required in the use of autonomous, or partially autonomous, vehicles.

In most major markets, over 50% of consumers would prefer vehicles to have at least a basic level of automation integration. Advanced automation technologies were even more popular, especially in China and India:

U.S. and South Korean consumers are particularly skeptical of autonomous vehicle safety, with nearly 75% of U.S. consumers, and 81% of South Korean consumers surveyed reporting safety concerns.

Consumer Trust in Full Self-Driving Vehicles

The lack of consumer trust in limited self-driving and full self-driving technologies is apparent; most consumers in South Korea, the U.S., Japan, and Germany prefer vehicles not equipped with full self-driving capabilities.

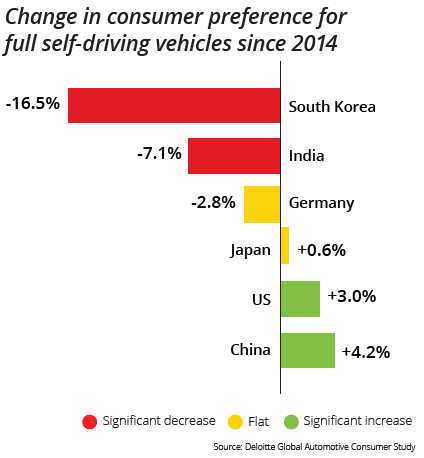

Since 2014, many consumers’ enthusiasm for autonomous driving technologies has decreased, with large changes in opinion seen in the South-Korean and Indian markets. This has been offset by strong and growing interest in the two largest automotive markets in the world, however; the U.S. and China.

Who Will Deliver Superior Full Self-Driving Vehicles?

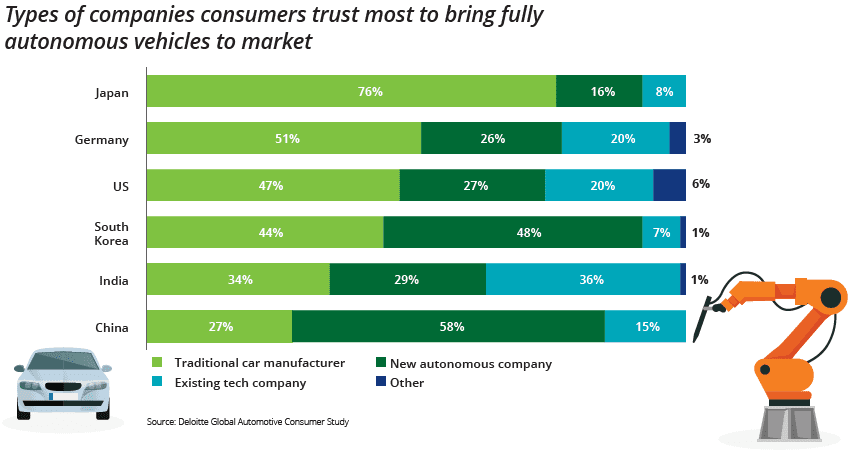

Consumers tend to differ on which companies they trust to bring safe self-driving vehicles to market. The work of technology firms Google and Apple on their own self-driving car software platforms has provided opportunity to non-automotive OEMs to succeed in the self-driving market.

Google has developed its own self-driving vehicle, Waymo, from the ground-up. Apple is also actively testing their own self-driving car hardware system in California. While many consumers trust these relative newcomers to the automotive sector, many more still trust and expect conventional automotive OEMs to deliver a safe and reliable product.

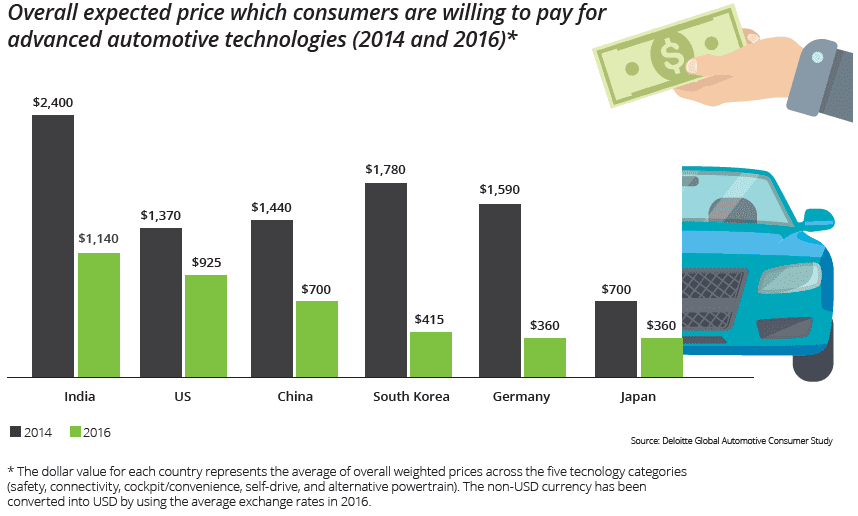

Consumer Willingness to Pay for Advanced Vehicle Technologies

Although many consumers appear to be enthusiastic about self-driving technologies, the price consumers are willing to pay for this and other advanced vehicle technologies has declined significantly since 2014. The Japanese market, which Deloitte notes is known for consumers more willing than most markets to pay for new technologies, posted a 48% drop in the average price consumers are willing to pay for advanced automotive technologies, clarifying that:

Consumers expect advanced technology features that were once considered premium options to become standard features that do not increase the price of the vehicle.

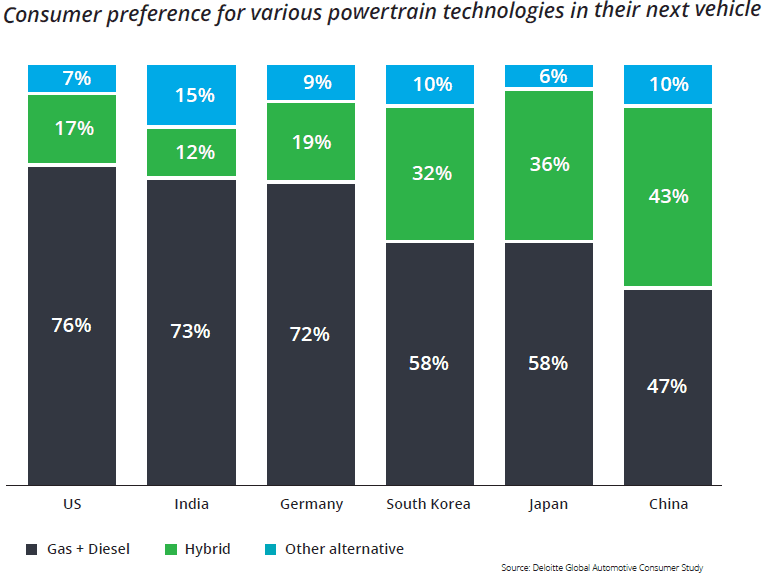

Electric Vehicle & Hybrid Power Vehicle Demand

Deloitte notes strong interest and demand for hybrid and alternative powertrains (including electric vehicles and hydrogen vehicles) worldwide, especially in Asian markets. Deloitte reports that,

Global demand for hybrid vehicles could rise significantly in the next three to five years.

Bloomberg New Energy Finance also forecasts that, during the 2020s, electric vehicles (EVs) could become a major component in the global transportation mix. Worldwide, less than 500,000 EVs were sold in 2015; Bloomberg forecasts that, by 2040, that number could increase to 41 million units sold annually, with long-range electric cars costing $22,000 USD (today’s dollars) on average, and that 35% of all new cars sold will have full-electric drive capabilities.

Published: June 2017. Updated: November 2017.