Canadian Small Businesses Trends: Optimism in Summer 2017

The Bank of Canada’s quarterly Business Outlook Survey summarizes interviews between the bank and approximately 100 senior managers from businesses across Canada. Its purpose is to gather the perspectives of these businesses on topics such as demand, capacity pressures, and other economic indicators.

The Summer 2017 Business Outlook Survey signalled that businesses are gaining strength and becoming more optimistic despite potentially unfavourable U.S. trade policies being tabled. In fact, the report is one of the most optimistic on record and demonstrates that businesses expect market improvements over the coming year. The last time Canadian companies were this optimistic was Summer 2011.

The report shows particularly strong sales growth (both past and future), but also that businesses expect capacity issues (including labour shortages) to increase. These issues could make it difficult to seize new market opportunities; therefore, proactive companies should use the remainder of 2017 to improve capacity. Two ways to achieve this are investing in hiring and training initiatives and adopting new technologies.

Related Blog: Canadian Manufacturing in 2017: An Industry Poised for Sustained Growth

Highlights of the Summer 2017 Business Outlook Survey

Three small business trends led to business owners and executives to feel optimistic about the coming year. This includes:

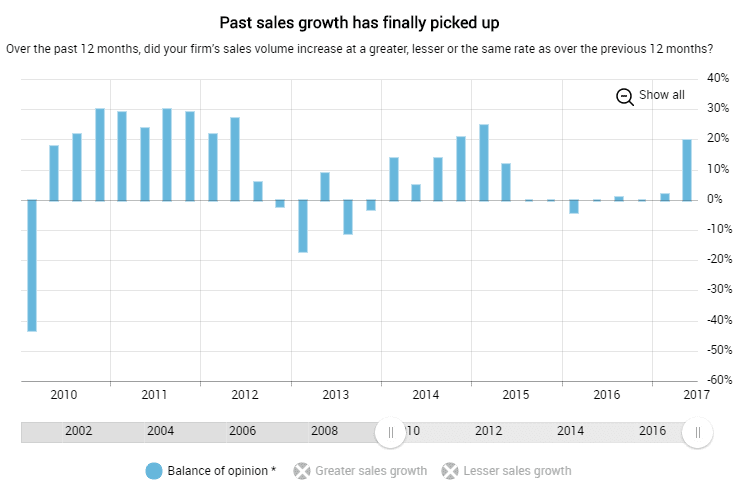

Past Sales Growth

43% of survey respondents claimed that sales volume over the past 12 months exceeded sales volume from the 12 months prior. Although this is offset by 23% of businesses who believe their sales have dropped over the past year, a balance of opinion of 20% is the best result recorded in over two years.

An increase in sales over the last 12 months should signify that Canadian firms have extra cash on hand; this is an opportunity to invest those earnings back into the business and prepare for future demand. Consider implementing profitability-boosting projects now while the cash is available.

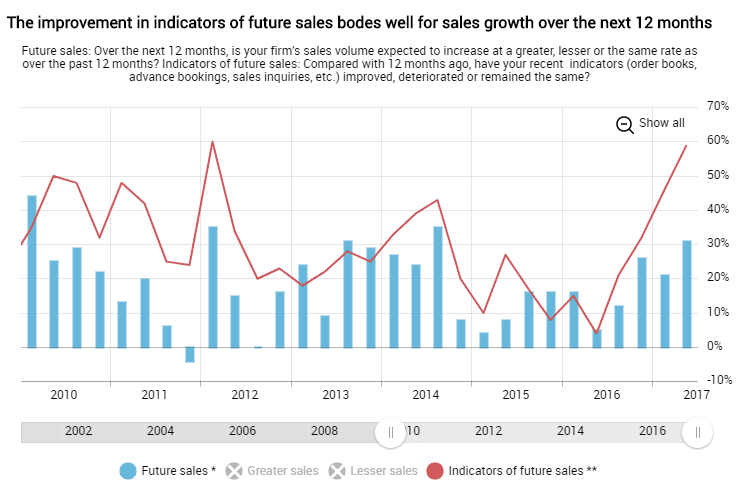

Future Sales Growth

Another measure that shows great optimism in Canada’s business community is future sales expectations. 50% of businesses expect that their sales over the coming 12 months will surpass sales over the past 12 months, with a 31% balance of opinion. Furthermore, 59% of companies have seen an improvement to future sales indicators, such as advance bookings and sales inquiries.

After a full year of upward momentum for future sales indicators, it’s not surprising that there was finally a breakthrough quarter for past sales growth. Canadian businesses should keep searching for new international customers to take advantage of a low dollar value and drive new sales over the coming year.

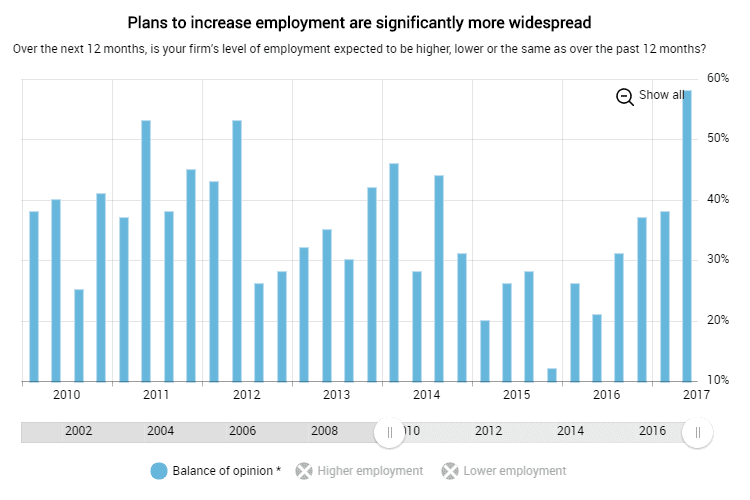

Employment Intentions

66% of Canadian businesses are planning on intense hiring in Q2 2017. With only 14% of companies projecting lower employment, the 58% balance of opinion is the highest ever recorded in the Business Outlook Survey’s history.

These positive hiring intentions are broad-based across all sectors and regions. This is largely demand-driven; companies are needing to grow to keep up with incoming orders. To prepare for growth in future sales (as displayed in the previous chart) companies need to implement a structured recruitment and employee development program.

Find government grants for hiring and training new employees.

Concerns from the Summer 2017 Business Outlook Survey

Alternately, three small business trends led to business owners and executives to feel concerned about the coming year. This includes:

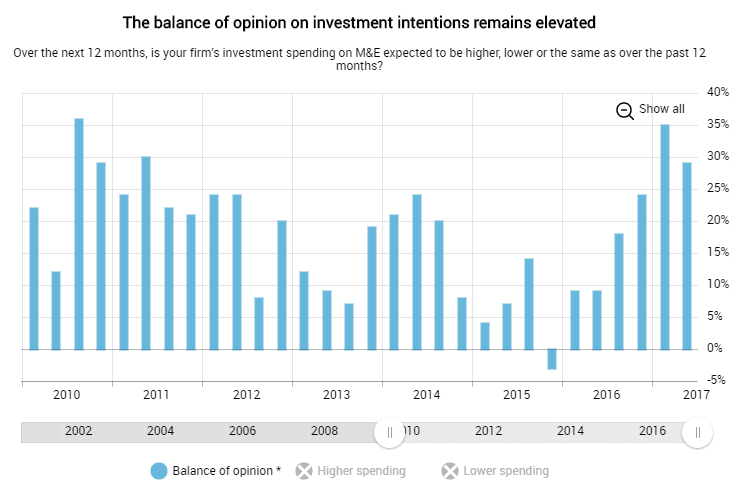

Decreasing Investments for Machinery and Equipment

Since Spring 2017 there was a 2% increase in the number of businesses who will spend more on machinery and equipment (M&E) over the coming year. While this may be a positive, 8% of businesses are now planning on spending less over the same time. This difference has decreased the balance of opinion from 35% to 29%, signaling significant contraction in Canadian machinery investments.

These equipment investments will be critical to businesses keeping up with growing demand. Although companies can continue hiring and training more employees, there are long-term efficiency gains that can be made through innovative machinery.

Access Canadian government funding to improve capital investment projects.

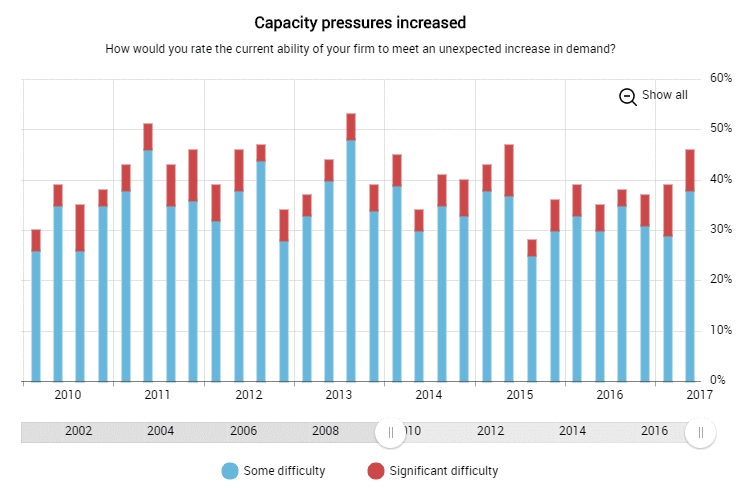

Capacity Pressures

In Q2 2017, capacity pressures rose to the highest levels seen since Q2 2015. Although most of these firms are only experiencing some difficulty responding to demand increases, it shows that Canadian businesses may have difficulty responding to a growth in future sales. If Canadian companies are unable to respond to this demand, customers will begin looking for companies elsewhere to pick up unfilled orders.

Capacity pressures are concentrated in British Columbia and Ontario, where robust demand has increased competition for labour, but remain modest in other regions, particularly the Prairies where the energy sector is slowly rebounding. Canadian firms should continue investing in capital investment and workforce development projects to expand capacity and ease this building pressure.

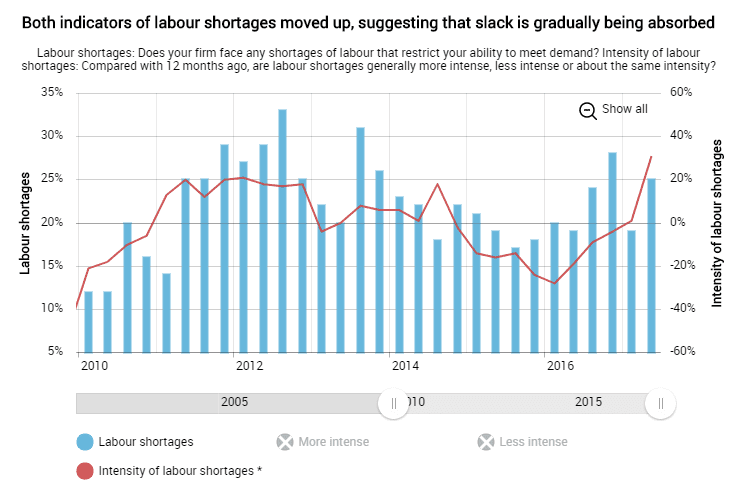

Labour Shortages

It’s becoming more difficult for Canadian businesses to maintain a full workforce, which is beginning to impact their ability to meet customer demand. 25% of companies currently have a labour shortage, and this figure may continue to climb as firms believe labour markets to be intensifying and more competitive than they’ve been for some time.

While 40% of companies believe labour shortages are more intense than they were a year ago, only 9% feel they are less intense. This 31% balance of opinion is the highest reported figure since 2007, proving that employers are feeling more strain to find qualified employees than in recent history.

Canadian Government Grants and Loans for Small Businesses

While the Bank of Canada’s Summer 2017 Business Outlook Survey highlighted some bright spots where companies are growing, it’s hard to ignore the looming dark clouds: decreasing capital investment and workforce shortages. Although Canadian companies have new global growth opportunities, immediate action is required to access and exploit them.

Canadian government grants and loans are an intelligent option for businesses making capital investments or performing workforce development initiatives. Small business funding can help to offset a portion of project costs and improve project outcomes; this ultimately improves company capacity and responsiveness to opportunities.