Top Shops: How to Become a Market Leading Machine Shop

What does it take to be a machine shop Top Shop? Adopting lean practices? Working in a highly specialized niche? Being flexible to produce a variety of products? Cost leadership? More importantly how do you get to be a Top Shop if you aren’t already? In this post I review some strategies for becoming a Top Shop.

Where Are You Now? Setting a Benchmark

Traditional manufacturing entity performance has been based primarily on the analysis of disclosed financial statements and accompanying notes from public operators. A benchmark is then established across entities in a sector by industry analysts heavily loaded with industry sentiment scores and speculative commentary. Meanwhile software and hardware firms pitch business an endless array of new solutions for faster and better performance, typically with lavish claims as to the financial return. The odd publicly disclosed success story can send the industry in panic to adopt the “new winning strategy”.

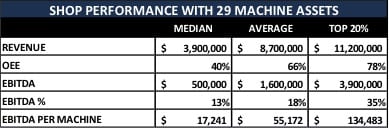

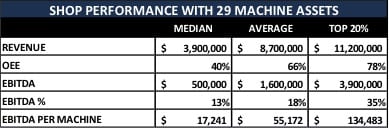

The reality is that a drastic degree of performance is driven by how well a firm uses its assets. Overall Equipment Effectiveness is a hierarchy of metrics which evaluate how well a firm is utilizing its assets. The table below provides a compelling argument for doing more with what you have in place.

What Makes a Top Shop?

Fortunately there is a study conducted annually by “Top Shops” that provides some great direction. Modern Machine Shops surveys over 500 manufacturers of Small and Medium machining businesses to create Manufacturing Trends annually. Here’s a quick summary of trends over the past few years.

Snapshot

- Invest in more advanced equipment for single setup, programmability, and high speed. They have similar total assets and annual investments, but they must select an investment strategy that favours a larger allocation to more advanced equipment.

- Automate basic transition processes (eg. pallet switches, unloading, etc) and equipment maintenance tasks (eg. cooling).

- Have a comprehensive tooling maintenance and monitoring plan (fewer surprises, lower re-work, lower scrap).

- Invest heavily in performance improvement methodologies, especially continuous improvement, quality, kanban, and cellular manufacturing.

- Pay a similar loaded wage on average but the best shops save approximately 10% overall (I presume this is overtime savings).

- They produce more (volume), and more complex parts but focus on those that can be automated.

- They focus more heavily on scheduling, machine monitoring, and connectivity.

- Their revenue per part and revenue per SKU is much lower. They service nearly double the client base, but they are able to focus on large batches and presumably smaller parts that have high design complexity, but can be programmed. Eg. a watch is not necessarily less complex (in machining provision and quality) than a car, but it is much cheaper and faster to make.

- Their biggest gains are: lower scrap, lower re-work, more machine time per day, and better spindle utilization.

They purchase significantly less materials. Materials as a percentage of sales is much lower.

Major Strategic Process Differences

Top Shops invest in more advanced equipment and perform more complex, automated, and programmable work, including:

- 5 axis-CNC machining: Reduced setups and greater complexity.

- Lights-out machining: No human involvement – full automation.

- High-speed machining: Fast cycle times and throughput.

- Hard turning: Shorter setup, faster cycle times, dry cutting, and single clamping.

Best Tooling Strategies

In general, Top Shops use significantly better tooling strategies. This may result in a net break even on tooling (cost of tooling replacement vs. cost of tooling maintenance), but results in fewer unexpected down-times, scrap work in progress, re-work, and idle time between setups (in my opinion). Some of these strategies include:

- Carbide Recycling;

- Coolant Management;

- On Machine Probing;

- Tool Inventory Management;

- Tool Pre-setting; and

- Minimum Quantity Lubrication.

Workhold Strategies

Top Shops automate device, pallet, and fixture change overs 30% more frequently. They also use magnetic chucks 30% more frequently, and vacuum chucks 47% more frequently. Tombstones are common which falls in line with the more automated ‘lights off’ approach.

Software Utilization

Beyond standard machine shop software such as CAD and ERP systems, Top Shops leverage additional job estimating and SPC/quality management software approximately 40-50% more often.

Materials Processed

Top Shops machine less cast iron, titanium (very dense), other high-temp alloys, and copper. They focus on mild steels, aluminum, stainless steel, and brass. This makes sense given the need for a fast, automated, and high design diversity production. No major distinctions on non-metallic plastics vs non-Top Shops. Top Shops due vastly focus on general plastic (80%+) vs medical, carbon reinforced, or other plastics.

Product Mix

Top Shops produce significantly more SKUs (40-250% greater), typically with more parts (200-300%), and they typically are able to run a larger batch size (20-40% greater)

- 50% of Top Shops run contracts for repeat part numbers (defined product, process, quality, lead time, price).

- Only 1/3 of Top Shops run short order jobs (custom job orders, non-repeating, multitudes of setups, etc).

- Tops Shops by far produce the most parts. Range 4.5K to 7K upper threshold. Non-Top 3.6K to 2K.

How do I get there?

If you aren’t a Top Shop already, there are dozens of Canadian government funding programs that can support the investments required to get there. Whether you are looking to invest in more automated equipment, process optimizations, training, or similar, there are grants that can subsidize between 25-60%+ of your project expenses. Attend one of our business funding webinars/workshops to learn more.