Celebrating One Year in the Ryan Family

On October 1, 2021, Mentor Works was proud to join the Ryan family. Over the past year, Ryan has welcomed Mentor Works into its organization with open arms and combined Mentor Work’s expertise and knowledge in Canadian government funding with industry-leading tax recovery, consulting, advocacy, compliance, and technology services.

Mentor Works has been offering tailored funding solutions to support business growth and innovation for nearly 14 years. Through our team of experienced grant writers and proper management of government funding applications, Canadian businesses continue to benefit from the significant competitive advantage secured by a comprehensive funding strategy.

Our mission is to revolutionize how Canadian enterprises access government funding to stimulate innovation, economic development, and competitiveness. Businesses can focus on what they do best, while our strategic approach to funding helps accelerate their top priorities. Ryan has empowered the Mentor Works team to simplify the government funding process for our clients and provide unmatched customer service.

What Have We Achieved?

With the additional support and resources provided by Ryan, Mentor Works has seen significant growth over the past year, which translates into more value for our clients.

Funding Won

Since joining the Ryan team, Mentor Works has secured over $70 million in funding for our Canadian clients, with over 450 unique winning applications securing upwards of 85% of the total funding requested. In some cases, we were able to secure 100% of funding for some non-profits –an incredible achievement.

Funding won scaled a broad range of project activities, including everything from grants and wage subsidies for hiring and training to loans and tax credits for innovative research and development initiatives.

Capacity

To help our clients achieve the level of financial support needed to grow, innovate, and drive Canada’s economy, our team had to grow as well.

With a commitment to growth and improving our processes, we added new team members to increase writing capacity and expand our support team – ensuring our clients always have access to a team member to talk to about program updates, eligibility criteria, deadlines, and more.

More About Ryan

Ryan is an award-winning global tax services and software firm achieving international recognition and market leadership through client service excellence, workplace innovation, and employee development. Ryan’s Canadian practice supports multinational companies operating across North America with a suite of international, federal, and provincial tax and technology services.

Customer Service Institute of America (CSIA) has awarded Ryan the International Service Excellence Award nine times for its commitment to excellent client service. Our multidisciplinary team of more than 3,600 professionals and associates serves over 18,000 clients in more than 60 countries, including many of the world’s most prominent Global 5000 companies.

More information about Ryan can be found at ryan.com.

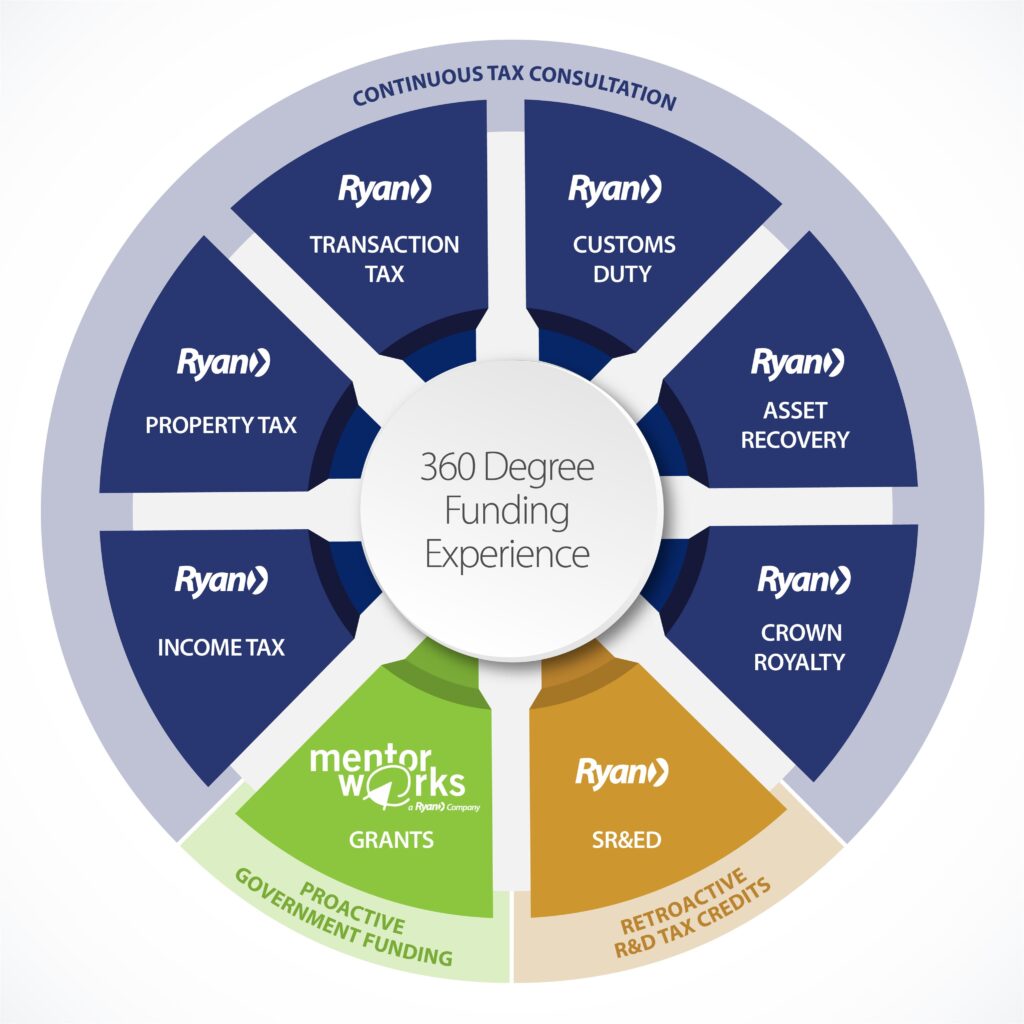

Offering a 360 Funding Experience

With the addition of Mentor Works, Ryan is the go-to organization in North America for a 360-degree approach to government funding that includes both proactive and retroactive grant opportunities, as well as continuous application and tax credit support.

Proactive Funding

Proactive funding refers to government support that is applied for prior to a project’s start. These programs work well for companies that can plan their projects in advance. Applications for many proactive government funding incentives (e.g., grants, loans, and vouchers) must be made long before the project start date and should articulate the anticipated value based on the activity or industry that the government wishes to stimulate. The combined Mentor Works and Ryan team of professionals has the capacity and expertise to facilitate applications for over 500 different grant, loan, and tax credit programs available to businesses across Canada.

Retroactive Funding

Retroactive funding refers to government programs that can be claimed by a business once that business has started or completed an eligible project. These incentives often come in the form of tax credits, such as the Scientific Research and Experimental Development (SR&ED) tax credit, which eligible businesses may claim annually upon project completion.

Retroactive funding programs can secure considerable tax savings for businesses that participate in R&D projects and can often be stacked with proactive programs to generate even greater government support. Ryan has been able to provide industry-leading expertise on retroactive programs to the Mentor Works network, providing complementary services that secure real results.

Continuous Tax Consultation

Moreover, Ryan provides a full suite of tax services to businesses across North America on a continuous basis, allowing our network to receive a constant flow of funding relief for not only big and exciting new projects, but many daily activities as well.

We’re Still Growing

Our one-year anniversary with Ryan has only accelerated our growth, including the recent acquisition of FundingPortal. Our team is thrilled to add one of the leading government funding SaaS platforms to our roster of tools that help consolidate funding opportunities and match clients to existing and upcoming programs.

FundingPortal’s incredible machine learning technology service paired with the application writing expertise at Mentor Works makes Ryan the clear leader in North American government funding services.

A Great Place to Work

Ryan’s amazing workplace culture has also stimulated a safe and prosperous workplace at Mentor Works. This year, Ryan was recognized by Great Place to Work Canada as one of the top firms for employees in the country for the 10th consecutive year, a true testament to the incredible workplace culture at Ryan.

Is Your Business Missing Out on Funding?

Operating a successful business in North America is extremely difficult. A 360-degree funding plan can help ensure your business has the support needed to reduce daily costs, fund large-scale projects, and take full advantage of all available tax credits.

Get in touch with our team today to speak with the leaders in funding support across North America. We’ll consult with your business on potential proactive funding opportunities, available retroactive funding programs and tax credit claims, and an all-encompassing financing plan for success.