How Electric Vehicles are Gaining Worldwide Popularity

The future of electric vehicles (EVs) are becoming increasingly clear. Battery and engine technologies are being researched and developed at record pace; this has allowed global consumer demand to increase steadily. As more consumers begin to understand the technology and feel comfortable investing in electric vehicles, the market will become dominated by this trend. This is just the beginning.

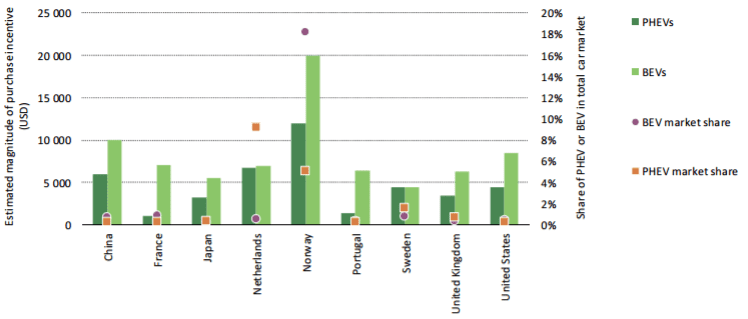

Although the future is bright for EVs, there is still a transition period occurring where traditional gasoline and diesel users are hesitant to switch over to electric power. For many, this transition includes the use of Plugin Hybrid Electric Vehicles (PHEVs) where the vehicle can operate off either a combustion or electric fuel source. Many drivers, however, have begun adopting vehicles that are completely battery-powered. While a spectrum of interest will always exist, its expected the shift from traditional energy to clean energy will continue to occur year-over-year.

Automotive manufacturers should focus on increasing production of electric-focused vehicles and technologies. All the world’s top automotive brands are planning their expansion into electric vehicles; global part suppliers should notice this trend and begin planning how they can contribute and take advantage of this opportunity.

Related Article: How Lightweight Vehicles Are Transforming the Automotive Industry

Early Signs of Electric Vehicle Acceptance

In some markets, the potential for electric vehicles to become widely adopted is clear, even today. The International Energy Agency, Clean Energy Ministerial, and the Electric Vehicles Initiative collaborated on the Global EV Outlook 2016 report to share key adoption statistics and forecasts for various global EV markets.

As displayed in the graph below, EVs have already attained strong market shares in several key markets around the world, as of 2015.

Source: IEA Global EV Outlook 2016 Report

- BEVs: Battery Electric Vehicles without combustion engines.

- PHEVs: Plugin Hybrid Electric Vehicles, with the ability to operate off either an electric motor or combustion engine.

Where are Electric Vehicles Gaining the Most Support?

Although European markets currently provide the highest market share for electric vehicles, there are many international markets just beginning to heat up and adopt EVs. North American consumers are coming around to electric power; this is well-demonstrated by the new push for electric technology development led in-part by companies like Tesla.

Strong North American PEV Growth Expected

The North American Plugin Electric Vehicle (PEV) market is poised to finally take off in 2017 and 2018, becoming a major part of the vehicle mix in this market. The release of the Tesla 3 in North America, expected in late 2017, will likely accelerate this market.

Navigant Research forecasts that the Tesla 3 will likely “boost the North American PEV market by around 60% in 2017 and then nearly double the market in 2018 after the first full year of Model 3 sales.”

Related Article: Tesla’s “Master Plan, Part Deux” Pushes Innovative Business Leadership

High-Growth Chinese PEV Market

Accelerated growth will not be exclusive to the North American market, but is expected worldwide. Clean Energy Canada, a program of the Centre for Dialogue at Vancouver’s Simon Fraser University, notes that in China “a decade ago, there were only a couple thousand electric vehicles on the road worldwide. [In 2016] they cruised past a million—and kept going.” Clean Energy Canada also reports that China plans to add as many electric vehicles in 2017 as exist worldwide today.

Impact on Ontario Automotive Manufacturers and Technology Developers

A report on the Economic Impact of Electric Vehicle Adoption in Ontario sheds some light on the impacts that EVs could have on North American Jurisdictions economically, noting the following key impacts, among others, if EVs reach 10% of market share in Ontario by 2025:

- Total economic income of $3.6 billion created;

- 34,000 person-years of new employment created;

- Large energy savings due to decreases in use of non-renewable fossil fuels;

- Reduction in CO2emissions;

- Developing a new and growing industry with sizable employment opportunities for skilled employees; and

- Development of an extensive network of charging-station infrastructure, stimulating construction activity.

Canadian Government Grants and Loans for Electric Vehicle Development

Canadian automotive technology developers have an opportunity to invest in electric vehicle development now, before the industry booms and becomes more competitive. Although some automotive businesses are hesitant to invest in electric vehicle technologies on their own, government grants and loans can be used to offset a portion of project costs.

By using Canadian government funding for EV-related projects, it’s possible for companies to accelerate projects and reach the market faster, ultimately helping to generate increased revenues. Some of the programs currently available to automotive technology developers include:

Automotive Supplier Investment Fund (ASIP)

The Automotive Supplier Innovation Fund (ASIP) offers Canadian government grants to automotive manufacturers researching/developing innovative products or processes. This includes prototyping, product engineering, pre-commercial testing and validation. Only automotive suppliers with fewer than 500 employees or less than $1B in global revenues may apply.

ASIP may provide Canadian automotive grants valued up to 50% of eligible project expenses to a maximum $10 million.

Automotive Innovation Fund (AIF)

Likewise, the Automotive Innovation Fund (AIF) provides government funding to support technology-focused investments in Canada. The primary difference between AIF and ASIP, however, is that AIF generally provides support for larger automotive suppliers and manufacturers. Large-scale projects, such as the development of automotive products, development of new production methods, or new/expanded facilities for fuel-efficient auto production, are common through AIF. Applicants must provide a minimum project investment of $75 million over 5 years to be considered.

AIF may award automotive grants or repayable funding up to 10-15% of eligible costs to a maximum $80 million. Only projects with a focus on environmental sustainability will be eligible for grant funding.

Sustainable Development Technology Fund (SD Tech)

Alternately, the Sustainable Development Technology Fund (SD Tech) allows Canadian tech developers to lead their project towards commercialization. Projects typically last 2-3 years and focus on developing disruptive technologies that will replace existing technologies and reduce greenhouse gas emissions, environmental contamination, or water consumption.

The SD Tech Fund may provide up to up to 33% of eligible project expenses to a maximum $15,000,000 in Canadian government grants.