Avoid COVID-19-Related Layoffs with Government Funding Programs

In order to help employers keep their staff working and avoid layoffs, the federal and provincial governments have created multiple funding programs and wage subsidies to keep Canadians employed.

Many Ontario employers have been ordered to temporarily close operations due to the provincial government’s shutdown of all non-essential workplaces and are unable to work remotely.

Thankfully, many of these funding programs will help offset payroll costs when bringing employees back to work after the shutdown.

Temporary Federal and Provincial Relief From COVID-19

Subsidize 75% of Employee Wages: Canada Emergency Wage Subsidy Program (CEWS)

With all businesses affected in some way by COVID-19, the federal government has introduced the Canada Emergency Wage Subsidy Program (CEWS) to alleviate a portion of payroll expenses for eligible businesses. This program provides a subsidy equal to up to 75% of remuneration paid to employees (with a weekly cap of $847 per employee) over 90 days, retroactive to March 15.

Eligible employers include:

- Individuals;

- Taxable corporations; and

- Partnerships consisting of eligible employers, non‑profit organizations, and registered charities.

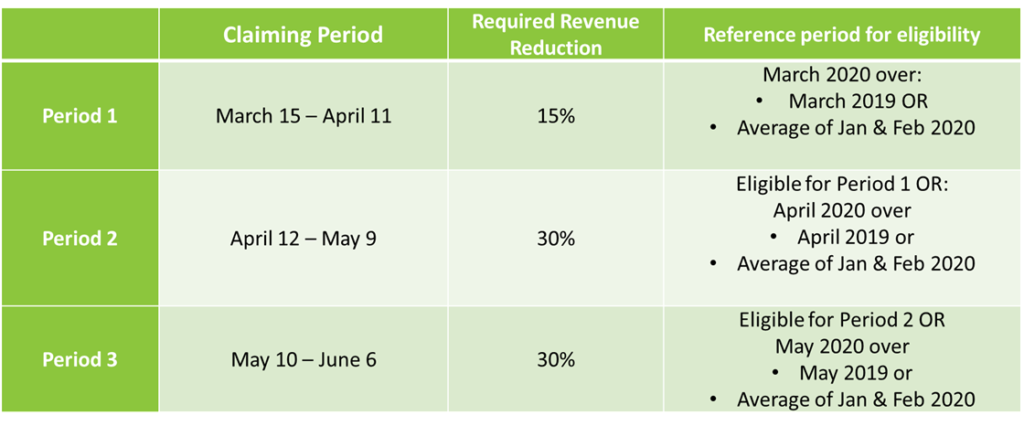

To qualify, applicant businesses must have seen a drop of at least 15% in revenue in March 2020, and 30% in each of April and May 2020.

Once an approach is selected by the employer on calculations, this approach must be applied throughout the program period of March 15 to June 6, as employers are not able to change their calculation method.

Businesses can apply for the Canada Emergency Wage Subsidy Program (CEWS) through the Canada Revenue Agency’s My Business Account portal.

Not Eligible for CEWS? Businesses Can Apply for the 10% Temporary Wage Subsidy

To help businesses not eligible for the 75% Canada Emergency Wage Subsidy Program, the Canadian government will provide eligible small business employers with a temporary wage subsidy for a period of up to three months (March 18, 2020-June 19,2020). This program was announced before the CEWS program.

- Subsidy will be equal to 10% of remuneration paid to employees during the period.

- Maximum total subsidy of $1,375 per eligible employee and $25,000 per employer.

- Businesses can benefit from this immediately by reducing their remittances of income tax withheld on their employees’ remuneration. Depending on how you file your taxes, this is done via MyAccount on the CRA website or through your payroll service provider.

Apply for the Temporary Wage Subsidy Program through the CRA’s My Business Account portal.

Let Employees Collect EI While Sharing the Available Workload with the Work-Sharing Program (WSP)

Many businesses across Canada are experiencing a temporary decrease in business activity due to COVID-19, and the federal government’s Work-Sharing (WS) program aims to assist with this disturbance. The program provides EI benefits to employees who agree to reduce their working hours and share the available work with coworkers, allowing their employer time to recover.

Businesses that meet all of the following criteria are eligible:

- A year-round business in Canada in operation for at least one year;

- A private business, a publicly held company, or a not-for-profit organization; and

- Have at least two employees in the work-sharing unit.

Businesses are not eligible if their reduced activity is due to any of the following:

- A labour dispute;

- A seasonal shortage of work;

- A pre-existing and/or recurring production slowdown; or

- A recent increase in the size of the workforce.

The process and complexity of the Work-Sharing program will depend heavily on your business’ size and payroll structure.

Speak with a member of the Mentor Works team for support with the Work-Sharing program.

Canadian Government Funding Programs

Canada Summer Jobs Paying Up To 100% of Student Wages

The Canada Summer Jobs program is offering wage subsidies for hiring eligible participants aged 15 to 30. Not-for-profit employers are eligible to receive funding for up to 100% of the provincial or territorial minimum hourly wage.

Public and private sector employers are eligible to receive funding for up to 50% of the provincial or territorial minimum hourly wage. This amount is capped at a maximum $300,000 per employer/province or territory. Maximum 40 hours/week/employee can be included.

COVID-19 Wage Subsidies to Help Supply PPE and Sanitization Equipment

The National Research Council Industrial Research Assistance Program (NRC IRAP) has added a COVID-19 funding stream in response to the medical equipment shortage that has resulted from fighting the novel coronavirus. This grant funding for R&D will help small and medium-sized businesses temporarily pivot their business model to provide innovative solutions to Public Health Agency of Canada and Health Canada needs.

NRC IRAP is looking for businesses that can provide innovative solutions in fulfilling any of the following needs:

- Personal protective equipment

- Sanitization

- Diagnostic and testing

- Therapeutics

- Disease tracking technology

Take action against the novel coronavirus impacts and register for one of our upcoming Webinars on COVID-19 Canadian government funding programs.