Economic Action Plan 2015: What Your Business Needs to Know

April 1st marked the first day of the Canadian government’s 2015 fiscal year and with it, came an update to the Economic Action Plan (EAP), an initiative to benefit Canadian businesses, families, and seniors. This article will focus on the business elements of EAP.

The Canadian federal government created the Economic Action Plan in response to the recession and since then, they have created over 1.2 million net new jobs via funding support and resources. Some elements of the EAP have changed for 2015, and it’s important to know how this will affect your Canadian business.

Reduction in Small Business Tax Rates

The Economic Action Plan 2015 proposed a reduction in small business tax rates by 2% of the federal tax rate applicable to Canadian-controlled private corporations (CCPC’s) for their first $500k of annual revenue. This will help small businesses remain competitive and improve cash flow. The current federal tax rates for businesses is 11%, which is set to decrease 0.5% per year for the next four years:

- January 1, 2016: 10.5%

- January 1, 2017: 10%

- January 1, 2018: 9.5%

- January 1, 2019: 9%

This reduction in taxes is anticipated to provide $2.7 billion in tax relief by the end of the 2019/2020 fiscal year.

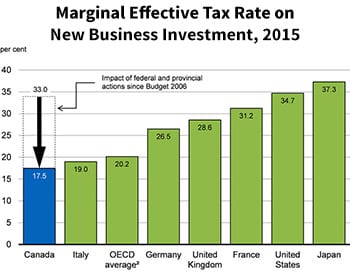

Canada’s Department of Finance outlines that federal and provincial actions on the marginal effective tax rate has decreased a potential 33% tax rate down to 17.5%, making it the lowest among the G7 countries.

GDP Growth & Government Funding Programs to Spur Economic Performance

Although crude oil supplies, one of Canada’s major exports, increased steadily in 2014, our nation is still expected to grow at a pace of about 2% in both 2015 and 2016. Canadian government funding and other support through the Economic Action Plan 2015 will provide nearly $10 billion towards supporting the Canadian economy.

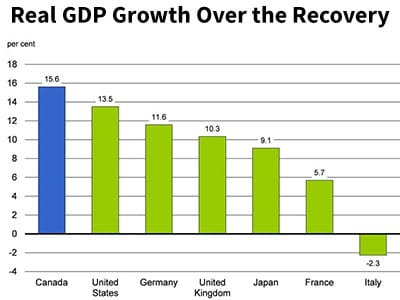

Haver Analytics, Department of Finance calculated the above GDP figures to illustrate Canada’s ability to recovery from the economic downturn with the highest percentage of GDP growth since that time among the G7 countries.

Canadian Government Grants, Tax Credits & Repayable Funding

The Canadian federal and provincial government have supported native companies through a variety of small business funding grants, tax incentives, and repayable funding programs. Last year, businesses gained access to the Canada Job Grant, a training grant to help develop the Canadian workforce through skill development and formal training opportunities.

As part of the Economic Action Plan 2015, the government is planning on supporting industry and activity specific initiatives through a breadth of new and updated programs, including:

- Automotive Supplier Innovation Program: $100 million over five years dedicated to support product development and technology demonstration initiatives by automotive parts suppliers and manufacturers.

- Defence Procurement Strategy: Starting in 2016-2017, a new program will be introduced to increase the analytical capacity of the nation’s defence procurement processes with $2.5 million in annual support.

- Canada Foundation for Innovation: Starting in 2017-2018, this new initiative will reinforce Canada’s advanced research institutions, such as colleges and universities with $1.33 billion over six years.

- CANARIE: Canada’s world-class high-speed research and education network will receive $105 million over five years, commencing in 2015-2016.

- National Research Council (NRC): Will receive $119.2 million over two years to help business improve their competitiveness by developing new, innovative products and technologies. This investment will include IRAP’s Business Innovation Access Program (BIAP), introduced in the 2014-2015 fiscal year as research and development funding to fuel industry-academic R&D collaborative activities.

- Mitacs: The popular research and development funding support organization received $56.4 million over four years, starting in 2016-2017 to support collaborative R&D activities between industry and post-secondary interns via grants and incentives.

- Futurpreneur: $14 million has been provided to this startup/entrepreneur support institution over two years.

- Programs for Exploring Export Opportunities: $50 million was dedicated to programs such Export Market Access, to help SMEs improve their export capabilities,

- Trade Commissioner Service: $42 million over five years was dedicated to expand this export support service’s reach, as mentioned in our recent Trade Commissioner Service blog.

Mentor Works will be hosting a wide range of free Canadian government funding events to outline the above items, as well as additional small business funding programs for Canadian businesses. Please register today, as spaces are limited. If your businesses is still evaluating whether you want to move forward with funding, our free “Comparing Funding Types” download will help you understand what’s available to you. For more funding updates, please follow me on Twitter and connect with me on LinkedIn.