2018 Canadian Manufacturing Industry Trends and Investment Intentions

Earlier this year, PLANT Magazine and Grant Thornton LLP released their annual Manufacturers’ Outlook publication. The comprehensive source of business practices and management attitudes identified several key trends that demonstrate a fast-changing manufacturing landscape. While this year’s report is generally more optimistic than years past, it also identifies that manufacturing leaders are cautious about 2018 and the next few years ahead.

Despite uncertainty about Canada-U.S. trade relations, Canadian manufacturers believe that they will thrive, innovate, and drive employment across the country.

Most manufacturers plan to invest in new machinery and equipment, as well as their facilities over the coming year to make them more globally competitive. This will continue to drive positive impacts as higher input costs such as fuel and labour need to be offset through other savings. Manufacturers will also invest heavily in the research and development of new products and processes to create sustainable competitive advantages.

This article will further discuss some of the top challenges and opportunities Canadian manufacturers expect to face during 2018. It also examines how manufacturing businesses expect to finance growth projects and recommends government grants and loans to offset the costs of strategic manufacturing growth projects.

Overall Outlook for Canadian Manufacturers in 2018

Three metrics from Manufacturers’ Outlook 2018 were particularly enlightening as it relates to the health and future well-being of Canada’s manufacturing industry. These include:

Manufacturing Business Confidence

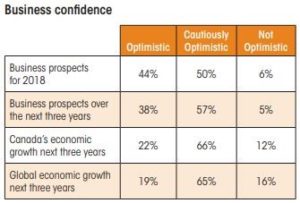

Canadian manufacturers are generally optimistic about how their businesses will perform in 2018. Even if this optimism is tempered with caution, it shows that there are more opportunities to succeed than there are to fail in the current manufacturing landscape.

Canadian manufacturers are generally optimistic about how their businesses will perform in 2018. Even if this optimism is tempered with caution, it shows that there are more opportunities to succeed than there are to fail in the current manufacturing landscape.

Around 40% of businesses are optimistic about their prospects over the next three years, with more expressing optimism for 2018 than in coming years. This could be tied to the shifting political landscape and development of new policies on either side of the border that could impact competitiveness. Very few companies are not optimistic at all – this is a sign that most Canadian manufacturers recognize opportunities for growth.

There is significantly less optimism, however, when it comes to the growth of Canadian and international economies. Around 20% of manufacturing leaders are optimistic, around 65% of companies are cautious, and nearly 15% of companies are not optimistic at all. This suggests that despite a sluggish global market for manufacturing growth, companies expect to perform comparatively well and succeed beyond international competitors.

Manufacturing Business Growth

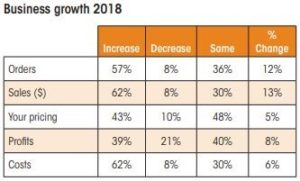

Much of the optimism surrounding Canadian manufacturing this year comes from internal performance metrics. When this data was collected in late 2017, survey participants indicated that they’d have growth in orders, total sales value, pricing, profits, and costs.

Much of the optimism surrounding Canadian manufacturing this year comes from internal performance metrics. When this data was collected in late 2017, survey participants indicated that they’d have growth in orders, total sales value, pricing, profits, and costs.

Two categories enjoying the largest year-over-year growth are orders and sales. Nearly 60% of Canadian manufacturers believe that 2018 will bring an increase in orders, while another 62% of companies believe the overall value of sales will increase. Each of these categories mark a change of over 10% from last year when companies were less optimistic about their performance capabilities.

Profits are expected to increase for nearly 40% of companies despite a rise in operating costs for over 60% of manufacturers. Increasing prices and sales are mitigating this rise in costs, although it should still be cause for caution for many companies.

Manufacturing Business Challenges

Not all signs point to growth for manufacturers this year, however. There are still significant challenges facing companies that limit growth potential and diminish international competitiveness. To succeed and thrive in the future, manufacturers must remain committed to addressing issues such as:

Not all signs point to growth for manufacturers this year, however. There are still significant challenges facing companies that limit growth potential and diminish international competitiveness. To succeed and thrive in the future, manufacturers must remain committed to addressing issues such as:

- Controlling and Reducing Costs: Rising payroll and energy costs are just two ways manufacturers expect costs to grow in 2018.

- Improving Productivity: It can be difficult to understand where productivity improvements can be made and how to prioritize those growth projects over other day-to-day operations challenges.

- Skills Gaps: Management and employees both require the right skillsets to grow manufacturing companies. There is a need for manufacturing skills at both levels, not just on the shop floor.

- Entering New Markets: Considerable time and resources are needed to develop new export markets. For manufacturers lacking the time, expertise, or risk tolerance, global expansion can be very difficult to achieve.

- Developing New Products: Driving innovation can be a significant challenge for manufacturers lacking the internal research and development capacity. While it’s important to offer unique and superior products, bringing ideas through to market-ready offerings takes considerable work.

- Production Capacity: Nearly a quarter of manufacturers are falling behind when it comes to meeting capacity requirements. This impedes the ability to take on new business and hinders company growth.

- Environmental Regulations/Costs: Legislative requirements now demand manufacturers pay close attention to their environmental impacts. Carbon taxes and Cap and Trade programs can be beneficial to manufacturers that are “going green,” but can also burden emission-intensive industries that do not implement changes.

- Access to Credit/Financing: Although a relatively small challenge to manufacturers this year, access to credit and financing for growth projects has historically been a sizeable challenge. Fortunately, more government funding programs and traditional financing solutions are helping support manufacturers’ investments.

Canadian Manufacturing Investment Intentions in 2018

Manufacturers’ Outlook 2018 identified, through several key areas, how Canadian manufacturers expect to grow over the coming years. These are true measures of business confidence since investing in Canadian operations takes commitment from a variety of business stakeholders. Some top insights from this year’s report include:

Manufacturing Investment (Next Three Years)

As many Canadian manufacturers plan to increase investments over the coming years, technology and workforce development will undoubtedly be the two largest areas of interest. These two categories alone can significantly improve an organization’s productivity and competitiveness, so it stands for good reason why they would be the go-to choice for manufacturing leaders.

As many Canadian manufacturers plan to increase investments over the coming years, technology and workforce development will undoubtedly be the two largest areas of interest. These two categories alone can significantly improve an organization’s productivity and competitiveness, so it stands for good reason why they would be the go-to choice for manufacturing leaders.

- Machinery, Equipment, Technology: Providing one of the most immediate gains to overall company productivity and profitability, technology and equipment will be a focus investment for nearly 80% of manufacturers.

- Training: Almost 70% of Canadian manufacturers plan to invest in employee training projects over the next three years. Although this is the second-highest investment category, it’s surprising more companies do not plan to train. As manufacturing processes and technologies become more complex, all manufacturers should consider improving employee skills.

- Research and Development: Half of manufacturers will perform research and development projects over the coming years. This innovation divide could lead to some manufacturers losing their competitive advantage, while those performing R&D projects will commercialize its results and drive greater profit.

- Productivity Projects: Lean/ Six Sigma projects remain a common area for manufacturers to reduce waste and drive productivity. Nearly half of Canadian automotive manufacturers plan to invest in these areas over the next three years.

- Upgraded, New Facilities: 30% of manufacturers will build, expand, or otherwise improve facilities in the near future. These types of projects lead to large-scale improvements in production capacity and international export potential, which is essential to success as Canadian manufacturers become less optimistic about Canada-U.S. trade relations.

- Business Intelligence, Data Analysis Systems: Despite a great focus placed on productivity improvements, only 28% of manufacturers will integrate new data-driven systems and processes. The Industrial Internet of Things (IIoT) and ERP/SCM tools offer substantial productivity benefits and visibility of the entire manufacturing process. Integrating them can help leaders improve their decision-making process, and in turn, lead to long-term success.

Manufacturing Investment (Previous Three Years)

When exploring manufacturing investment levels over the previous three years, Manufacturers’ Outlook 2018 reveals positive trends. Both categories, investment in facilities and investment in equipment, show greater numbers of manufacturers investing higher amounts. This investment growth is critical to gaining global competitiveness and increasing market share.

- Investment in Facility Expansion, Upgrades, and New Construction: Although a high number of manufacturers (~35%) have not had facility construction or expansion plans in each of the past three years, manufacturers who did have been investing more. Investments totaling less than $100,000 have significantly dropped off, while investments in the range of $500k to $10M have increased sizably.

- Investment in Equipment, Machinery, and Technology: Each of the past three years have seen a steady rise in the amount that manufacturers are investing into innovative production technologies. The average manufacturer will spend approximately $1.5 million on equipment in 2018, and manufacturers who do not plan to make significant investments has fallen for the third straight year to 18%.

Manufacturing Investment in Innovation

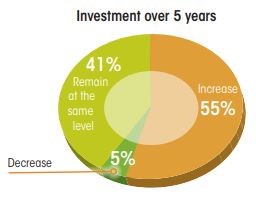

When looking ahead to the next five years of manufacturers’ operations, 95% of companies plan to invest the same or more than they currently do. This suggests that the facility and equipment investment trends identified above will continue to progress in a similar fashion.

When looking ahead to the next five years of manufacturers’ operations, 95% of companies plan to invest the same or more than they currently do. This suggests that the facility and equipment investment trends identified above will continue to progress in a similar fashion.

Those companies investing less in innovation will undoubtedly face challenges as domestic and international competitors drive innovation and continue becoming more productive. Although some manufacturers are part of less innovation-intensive sectors, it’s a big gamble to move backwards in an industry that is becoming more dependent on technological advancements.Canadian Manufacturing Industry Trends: 2018 Edition

Financing Manufacturing Investments

Manufacturers have some lofty investment expectations over the next three to five years. To finance these significant investments, companies will seek multiple forms of financing to get ahead and drive productivity. Some of the top methods include:

Manufacturers have some lofty investment expectations over the next three to five years. To finance these significant investments, companies will seek multiple forms of financing to get ahead and drive productivity. Some of the top methods include:

- Internally-Generated Cash Flow: By far the most popular form of project financing, nearly 75% of companies will rely on cash flow to cover project expenses. While this re-investment of company profits is a great sign, manufacturers should also explore other types of financing to grow at a faster pace and leverage new opportunities.

- Bank Financing: Over a third of companies will use bank financing to offset some of the upfront costs for large-scale investments. Members of this group also using internal cash flow will grow quickly, but need to remember that borrowing costs can limit profitability and needs to be done strategically.

- Government Programs: As a complement to cash flows and bank financing, Canadian government funding programs are a great way to leverage additional project capital. However, less than 20% of manufacturers will use government grants, loans, and tax incentives over the next three years; this is a missed growth opportunity for companies with the managerial capacity to lead large-scale strategic projects.

Impact of SR&ED Tax Credits on Manufacturing Innovation

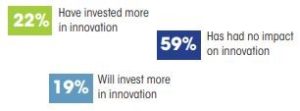

As identified in the above financing section, roughly 20% of Canadian manufacturers believe that government funding programs are worthwhile to pursue. This could be because of manufacturers’ impressions of the SR&ED tax credit that supports internal research and development activities. Fewer than 60% of companies believe it has/will impact innovation, while only 22% have actually invested more because of it.

As identified in the above financing section, roughly 20% of Canadian manufacturers believe that government funding programs are worthwhile to pursue. This could be because of manufacturers’ impressions of the SR&ED tax credit that supports internal research and development activities. Fewer than 60% of companies believe it has/will impact innovation, while only 22% have actually invested more because of it.

While the benefits of SR&ED tax credits have diminished over recent years, this should not cast an unfavourable impression among all Canadian government funding programs. Manufacturers can still drive considerable funding through government grants and loans; it just takes a slightly different mindset to seek these “proactive” incentives instead of “reactive” entitlement programs.

Canadian Government Funding for Manufacturers

PLANT Magazine’s Manufacturers’ Outlook publication suggests Canadian manufacturers are cautiously optimistic about the future and are investing in areas that improve competitiveness. And manufacturers have reason to be optimistic; investing in equipment and a highly-skilled workforce will support industrial sector growth and success for years.

Fortunately, Canadian government funding programs can award manufacturing grants and loans that offset a portion of costs related to strategic growth projects.

Through government incentives, manufacturers are better able to act on their market optimism and achieve the projects that improve profitability and lead to long-term success. Some of the ways manufacturers can take advantage of funding include:

- Domestic and International Market Expansion: Manufacturing grants to develop international plans, earn international certifications, and develop a client base by participating in trade shows or government-led trade missions.

- Productivity and Growth: Manufacturing funding to support investments in facilities and equipment needed to become more profitable and profitable. This can include hardware and software upgrades, facility expansion, and new facility construction.

- Workforce Development: Hiring and training grants can support a wide range of workforce development projects, including hiring student interns, recent post-secondary graduates, Masters and PhD students, or providing in-demand skills training to employees.

- Research and Innovation: Products and process development projects are well-suited to access Canadian government funding programs, especially if the project is collaborative (involving another business or post-secondary institution), or if the project’s results can be easily disseminated across the industry.

To learn more about how government funding supports manufacturing growth projects, please download Mentor Works’ Canadian Small Business Funding Guide.

Posted: May 14, 2018 by Jeff Shepherd. Updated: May 14, 2018 by Jeff Shepherd.